Elinext empowers financial firms with SaaS accounting services and accounting software development services, ensuring seamless migration to the cloud. By 2025, 78% of accounting firms had migrated to SaaS for real-time access and cost savings. Elinext helped a mid-sized company reduce IT costs by 35% and improve collaboration by using analytics to optimize workflows and ensure compliance.

Elinext: Leading Experts in Financial Software Development

Elinext specializes in SaaS accounting solution development. Providing financial software development services they created a customized SaaS platform for a European bank, automating reporting and regulatory compliance. Their experience guarantees scalable, secure, and innovative solutions tailored to each client’s needs.

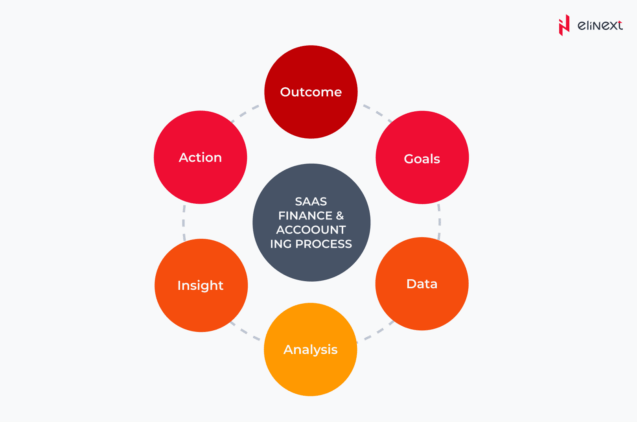

What is SaaS Accounting?

Accounting move to SaaS means moving from desktop programs to cloud platforms. SaaS accounting services provide anytime, anywhere access, automatic updates, and lower initial costs. The startup switched to SaaS and gained access to real-time financial information, improving decision-making and increasing flexibility.

Strategic Shift Toward SaaS for Financial and Accounting Companies

SaaS accounting services provided through the SaaS model allow companies to scale, reduce IT costs, and securely access data from anywhere. An audit firm improved its customer service using SaaS.

Elinext’s board of IT Directors organized a round-table meeting to announce that the company is amplifying its focus on developing SaaS solutions for financial and accounting companies.

Software-as-a-Service is a step forward from the traditional desktop application models. SaaS solutions can help financial institutions and companies reach a whole new level of service and improve performance.

“We are very positive about the opportunities the SaaS model can offer companies providing financial and accounting services”, said the speaker Alexey Shliakhouski, Elinext IT Services Director.

Elinext’s Expertise in Financial Software Development

Development of software for such companies requires profound knowledge in subject areas, because serious business logic, rich functionality, and sophisticated algorithms come to the forefront. “Financial software needs pinpoint accuracy and ultimate attention to details. People entrust the system in high numbers, millions at times. Therefore, no mistakes are allowed”, complemented Elinext CTO. “Talking about the level of our developers, we can tackle even the most complicated challenges. Our experience with market-leading global financial services companies is clear evidence for that“, proceeded Alexey Shliahouski.

Invest in SaaS accounting solution development to streamline operations, improve security, and drive innovation for the success of your financial company!

Case Study: SaaS Transformation for a US-Based Financial Client

One of the Elinext clients is a US-based provider of financial accounting and reporting services to various institutions and companies ranging from Fortune 100 to Fortune 1000. The client tasked Elinext financial software developers to create a new architecture of accounting software that could track the life of foreign exchange derivatives from inception up to realization.

Why SaaS Accounting Matters for Business Growth

SaaS accounting solution development facilitates business growth through automation, real-time analytics, and easy integration. Due to SaaS app development services small and medium-sized businesses scale faster.

Migration from Desktop to SaaS Web Application

Accounting move to SaaS allows companies to move from desktop to web-based applications, increasing mobility and efficiency. After migrating, the company reduced manual labor by 40%.

Choose mobile banking app development services to drive sustainable growth for your financial business with SaaS – improving security, mobility, and customer satisfaction!

Embracing Mobility and Tablet-Based SaaS Solutions

Accounting move to SaaS enables access from mobile devices and tablets. Accountants can now view reports on tablets during client meetings, improving efficiency.

Business Value and Future of SaaS Accounting Solutions

Banking software development services are shaping the future of SaaS accounting solutions. SaaS enables banks to automate regulatory compliance, reduce costs, and provide 24/7 access. A regional bank using SaaS reduced reporting time by 60% and increased customer satisfaction. As artificial intelligence and analytics advance, SaaS will provide even deeper insights, flexibility, and security, becoming the foundation of modern financial operations.

Conclusion

Elinext’s SaaS accounting solution development and SaaS platform transition experience enable companies to modernize their operations. Elinext migrated a legacy system to SaaS, enabling real-time collaboration and reducing IT costs by 30%. The company’s customized approach ensures secure, scalable, and compliant solutions, helping financial services companies remain competitive and agile in a rapidly evolving market.

FAQ

What services does Elinext provide for financial and accounting companies?

Elinext offers SaaS accounting solution development, custom integrations, automation, analytics, and ongoing support, helping companies modernize and scale efficiently.

Why should financial companies move to a SaaS model?

Accounting move to SaaS provides cost savings, real-time access, and scalability. Companies implementing SaaS reduce IT costs and improve customer engagement.

How does Elinext ensure data security in SaaS applications?

Elinext uses encryption, multi-factor authentication, and regular audits to protect SaaS applications. Banking clients meet strict compliance standards.

Can Elinext migrate existing desktop applications to SaaS?

Yes, Elinext migrates desktop applications to SaaS, ensuring data integrity and minimal downtime. An accounting firm seamlessly migrated legacy software to the cloud.

How does Elinext maintain and update SaaS applications?

Elinext provides continuous monitoring, automatic updates, and proactive support for SaaS applications. Clients regularly receive new features and security patches.

What types of companies can benefit from Elinext SaaS solutions?

Banks, accounting firms, fintech companies, and small and medium businesses benefit from Elinext SaaS solutions. A startup gained flexibility and compliance with the Elinext cloud platform.